In the realm of accounting, Chapter 13 accounting test answers emerge as a beacon of knowledge, guiding students and professionals towards a deeper understanding of financial concepts. These answers provide invaluable insights, enhancing comprehension, and paving the path to academic excellence.

As we delve into the intricacies of Chapter 13 accounting, the significance of these test answers becomes increasingly apparent. They offer a comprehensive roadmap, covering the scope and coverage of the subject matter, empowering learners to navigate complex accounting principles with confidence.

1. Definition and Overview of Chapter 13 Accounting Test Answers

Chapter 13 accounting test answers provide solutions to exam questions covering the concepts and principles of Chapter 13 in accounting. These answers serve as a valuable resource for students and professionals to evaluate their understanding, identify areas for improvement, and enhance their overall grasp of the subject matter.

Chapter 13 typically focuses on the accounting treatment of partnerships, including the formation, operation, and dissolution of these business entities. Test answers for this chapter address various aspects of partnership accounting, such as the allocation of profits and losses, the recording of transactions, and the preparation of financial statements.

2. Importance and Benefits of Chapter 13 Accounting Test Answers

Chapter 13 accounting test answers play a crucial role in the learning process, offering several key benefits:

- Assessment of Understanding:Test answers allow students to gauge their comprehension of the chapter’s concepts and identify areas where they need additional study.

- Enhanced Retention:The act of reviewing and working through test answers reinforces learning, promoting better retention of the material.

- Exam Preparation:Test answers provide valuable practice for upcoming exams, helping students familiarize themselves with the types of questions they may encounter and develop effective test-taking strategies.

3. Methods and Approaches to Using Chapter 13 Accounting Test Answers

To effectively utilize Chapter 13 accounting test answers, students should adopt the following approaches:

- Active Engagement:Engage with the test answers actively, attempting to solve the questions independently before reviewing the provided solutions.

- Comparative Analysis:Compare your answers to the provided solutions, identifying areas of agreement and disagreement. This helps pinpoint misconceptions and areas for improvement.

- Concept Reinforcement:Use the test answers as a starting point to delve deeper into the underlying concepts, seeking additional resources or seeking clarification from instructors or peers.

4. Examples and Applications of Chapter 13 Accounting Test Answers

Chapter 13 accounting test answers cover a wide range of topics, including:

| Topic | Example |

|---|---|

| Partnership Formation | Calculating the initial capital contributions of partners based on agreed-upon profit-sharing ratios. |

| Profit and Loss Allocation | Determining the distribution of profits and losses among partners, considering factors such as capital balances and service contributions. |

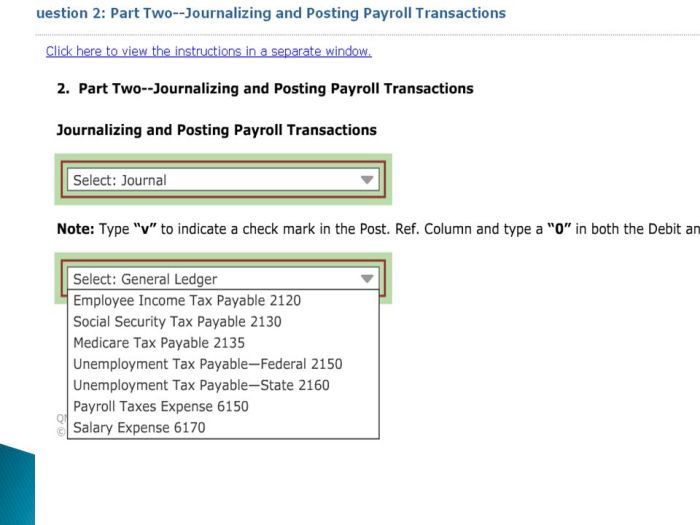

| Transaction Recording | Recording journal entries to document partnership transactions, such as cash investments, withdrawals, and asset acquisitions. |

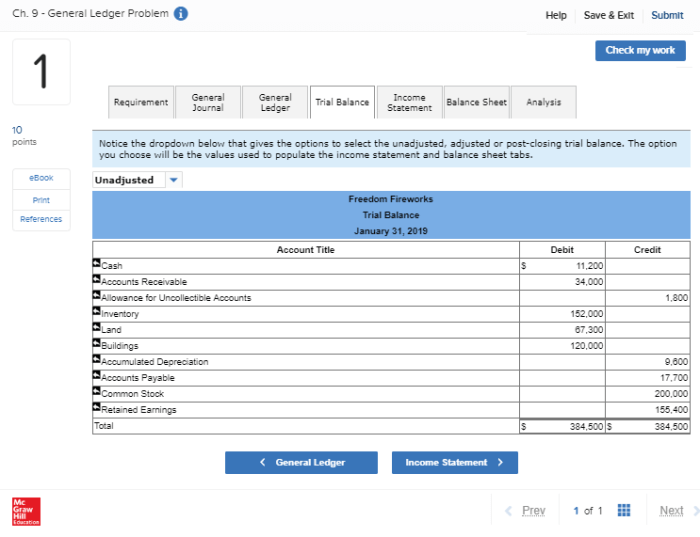

| Financial Statement Preparation | Preparing balance sheets and income statements for partnerships, incorporating the effects of partnership transactions and events. |

5. Resources and Tools for Chapter 13 Accounting Test Answers

Numerous resources are available for accessing Chapter 13 accounting test answers, including:

- Textbook Solutions Manuals:Many accounting textbooks provide solutions manuals that include answers to end-of-chapter test questions.

- Online Platforms:Websites and online platforms offer subscription-based access to test banks and solution manuals.

- Tutoring Services:Tutors can provide personalized guidance and assistance with test preparation, including reviewing Chapter 13 accounting test answers.

6. Ethical Considerations and Best Practices: Chapter 13 Accounting Test Answers

Ethical considerations and best practices should be observed when using Chapter 13 accounting test answers:

- Academic Integrity:Test answers should be used solely for self-assessment and not for plagiarism or cheating.

- Responsible Use:Test answers should not be shared or distributed without authorization, respecting copyright and intellectual property rights.

- Critical Evaluation:Students should critically evaluate the accuracy and reliability of test answers, seeking clarification when necessary.

Question Bank

What is the purpose of Chapter 13 accounting test answers?

Chapter 13 accounting test answers provide a comprehensive understanding of accounting principles, enhancing preparation and retention of knowledge.

How can Chapter 13 accounting test answers benefit students?

These answers serve as a valuable study resource, clarifying complex concepts, improving understanding, and boosting confidence in accounting.

What ethical considerations should be taken when using Chapter 13 accounting test answers?

It is crucial to use these answers responsibly, maintaining academic integrity by understanding the concepts rather than simply memorizing answers.